The 86th Texas Legislative Session - Schools and Taxes

February 13, 2019

Share:The 86th Texas Legislative Session is up and running and once again our representatives have promised great things on school financing and property tax relief. But rather than discussing what they are going to do, let’s discuss what they should do.

First, the Legislature must restore parity in school financing.

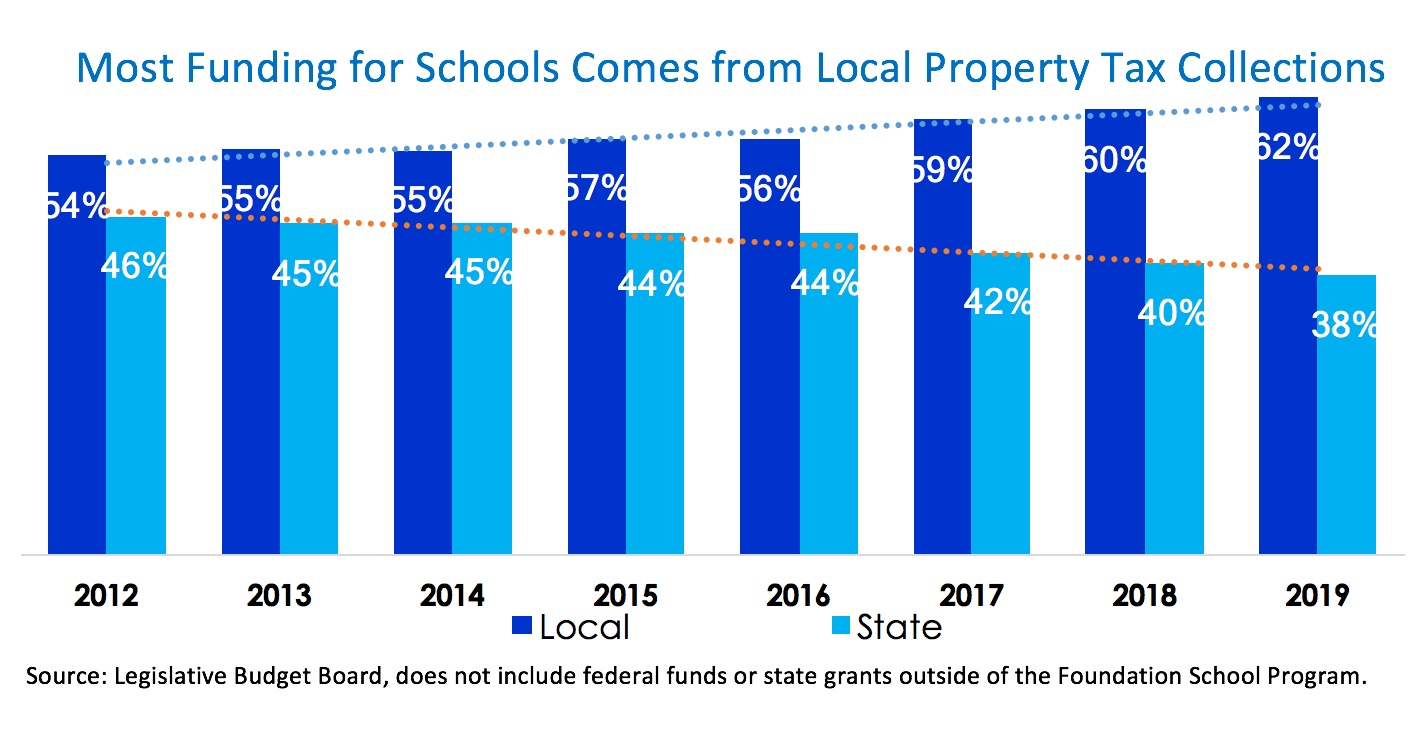

Ten years ago the state and the local school districts contributed equally to the cost of the local schools. Over that time we have seen the state’s share reduced to about 38 percent while the local district’s share has risen accordingly and is now about 61 percent. That increased local share comes from our property taxes.

Had the state funding percentage remained at the 2007 level, the state would have contributed $18 billion MORE and the local governments could have contributed $11 billion LESS.

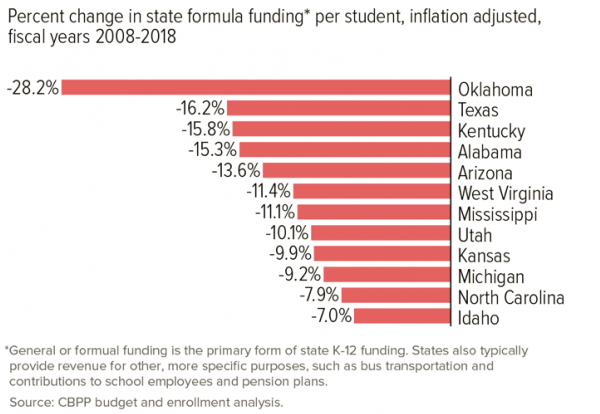

Even though the local governments have contributed substantially more than they did ten years ago, the total spending per-pupil has steadily drifted downward. Over this ten year period it is down about 16 percent. Increases in enrollment of almost 17 percent as well as the changing Texas demographics requires an increase – not a decrease - in spending. But today, Texas spends less per pupil than ever.

20 percent of our student body, more than a million, and speaking a multitude of different primary languages, are currently enrolled. The simple fact is that, as English learners, these pupils cost more to educate.

Our education funding shortfall is an annual issue, not a “one-off”. The Legislature must do more than write a one-time check.

- The state must restore its share of fully funding our schools.

Second, the State must stop influencing local property values.

“Wait, our appraisal district sets the local property values, right?”

Not entirely. Under the provisions of State of Texas Government Code Section 403.302, the state samples properties in each school district every two years. Based on this sampling, they extrapolate the value of all the properties in the district. The state then holds the local assessor to within 5 percent of the state-mandated “value” of the district. Given a sample size of about 1.5 percent and the seemingly intentional focus of sampling the hottest local real estate areas, most independent observers don’t view these samples as objective. And they are assuredly NOT market-driven.

In fact, the state’s thumb-on-the-scales is revealed by the baked-in property tax increases in the last state budget – assumptions that property tax revenues would increase 7 percent for 2017 and 6.75 percent for 2018. Now try to imagine that the state appraisers aren’t influenced by those “projected” numbers.

- The Legislature must permit our local appraisers to do their jobs objectively. They know our local property values better than the Austin politicians.

Third, the state must leave local governments in charge of local property tax rates.

The two legs of property taxation are valuation (see above) and tax rates. The state has usurped the valuation process, and now threatens to cap the local tax rates within a structure that almost guarantees the rate can never be raised by more than 2.5 percent. Indeed, what has become of local control?

While the valuation shenanigans are the main culprit in increasing property tax collections, the attempt to make it near-impossible for local officials to respond to emerging or urgent community financial needs is the final straw.

Our local governments know best what our needs are, and how best to meet them. We elect these people and they are accountable to us.

Austin should support our local communities and effect lower property taxes by paying their fair share for public education. That’s the single greatest contribution our legislators can make to property tax relief.

- The state must leave local tax rates up to local control.

FURTHER READING:

The state’s share of education funding is dropping, and the victims are our kids

The state’s declining support for public education in Texas

State deserves some blame for ire over rising property values and tax rates

Share: